Expansionary fiscal policy plays an important role in economic policy. This post gives you the definition and an example of expansionary fiscal policy. You will also learn how fiscal policy affects the IS LM model and how to graph this change.

In this post, we cover fiscal policy. You will learn what fiscal policy is and what fiscal policy measures a state can take to remedy an economic downturn. We explain to you what expansive fiscal policy is and its goals. You will get to know fiscal policy as a sub-area of financial policy.

Table of Contents

What is expansionary fiscal policy?

Expansive fiscal policy is used in times of economic weakness, even without reaching recession – technically, it is three consecutive quarters of GDP decline – and its basic objective is to stimulate growth and consumption by increasing aggregate demand.

When the economy is weak, consumption declines, companies increase their stocks and suffer an excess production capacity, reducing employment and wages. The less employment and lower wages, the demand suffers, and the economy of a country, the GDP, falls. You say goodbye, and factories close because what they produce is not sold.

To combat this negative economic scenario, governments have an expansive fiscal policy as a weapon.

What are the objectives of fiscal policy?

Among the objectives of fiscal policy, we can find the following:

- Stimulate the growth of the domestic economy and protect it from the changes of the economic cycles.

- Increase the country’s growth capacity through spending on R+D+i, education, investment in infrastructure, etc.

- Redistribute income between territories and people.

- Protect basic public services such as health and education.

- Maintain employment, reduce unemployment and seek to approach full employment.

- Guarantee minimum income levels for citizens.

- Control inflation by stabilizing prices by reducing public spending and raising taxes.

- Promote investment in the private sector and facilitate investment in the public sector.

How is an expansive fiscal policy implemented?

1.- Increasing public spending

Public spending is increased mainly with the construction of more infrastructure, from roads, railways, airports, hospitals or schools, even with aid to families and companies, which is known as transfers, which are still direct subsidies or with credits soft for certain family assumptions or for business projects that normally entail the generation of employment. It usually works in the short term, and with this type of action, the economy rebounds thanks to increased demand.

2.- Tax reduction

The tax reduction is made for the entire population, and generally, the one that is acted upon by lowering the tax rates is the IRPF. This personal income tax is a tax on work income or, what is the same, the payroll tax. You can also act on other kinds of taxes, such as donations, inheritance, savings or investment, lowering, for example, the tax burden on stock market capital gains depending on the generation period or rewarding the reinvestment of dividends.

The objective of comprehensive tax reform is for citizens to have more disposable income to spend, thereby contributing to reactivating the economy through greater aggregate demand. Suppose the money is in the pocket of citizens.

In that case, that money will end up producing benefits in society through purchases of different products that will cause an increase in sales of industry and services, requiring more personnel, thereby reducing unemployment and the social spending that entails meeting the increase in demand.

However, expansionary fiscal policy can be used in the short term since it has pernicious effects on the economy in the long term. Its main problem is that it generates a deficit or a lake simply because the State earns less than it spends.

To make up for this deficit, states must issue debt, which must be paid back to investors through interest. In the end, if the debt skyrockets, much public spending will attend to the interest payments on the public debt instead of reactivating the economy.

What is the following is an example of an expansionary fiscal policy?

Tax reductions and more harmful public spending are the primary signs of expansionary fiscal policy. Both measures boost overall demand while reducing the budget or adding to deficits. Typically, they are used during recessions to accelerate recovery or during recessionary worries to prevent it.

According to traditional macroeconomic theory, the government should employ fiscal policy to balance the natural expenditure decline and economic activity during a recession. Consumers and corporations reduce spending and investments as the economy worsens. This budget cut worsens the situation for the company and starts a vicious cycle that might be challenging to break.

- Tax reductions and greater government expenditure are two instances of expansionary fiscal policy.

- Recessions can be stopped or prevented with the help of an expansionary fiscal policy and high unemployment.

- A drawback of expansionary fiscal policy tax cuts is that they must eventually undo them. • The Economic Stimulus Act of 2008 permitted the government to put money into consumers’ pockets to encourage expenditure. According to John Maynard Keynes, fiscal policy is essential for reducing the harmful effects of slowing expenditure and economic activity.

- According to John Maynard Keynes, fiscal policy is essential for reducing the negative effects of slowing expenditure and economic activity.

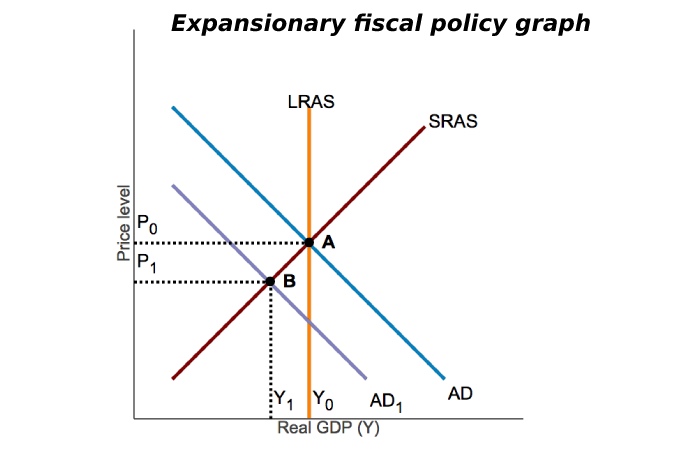

Expansionary fiscal policy graph

Let’s look at a concrete example of the IS-LM model. The graphic shows the basic IS LM model. The IS curve stands for the equilibrium in the goods market, and the LM curve describes the equilibrium in the money market. The interest rate r is plotted on the x-axis, and the total national income Y on the y-axis. The economy is in equilibrium when the IS and LM curves intersect.

Now let’s imagine that we are in an economic downturn. According to Keynes’s theory, we should now pursue expansive fiscal policies to boost the economy. It can be implemented, for example, by building new roads or by renovating universities.

Effect of expansionary fiscal policy

For a better understanding, Which of the following is an example of an expansionary fiscal policy? let’s look at the IS equation again:

As you can see, increasing government spending increases the right side of the equation, so the IS curve shifts outward. It increases national income from Y to Y` – the economy grows. Incidentally, the same result could also be achieved by reducing government revenue, for example, by lowering taxes. You can easily see this again from the IS equation:

Since the taxes T have a negative sign, the right-hand side of the IS equation increases because fewer taxes are “deducted”.

As you can see in the graphic, interest rates and national income are increasing. Of course, this increase could also lead to a dampening of investments in the medium term. Supporters of the Keynesian theory usually use the multiplier effect to argue here. Accordingly, the positive impact on national income is greater than the negative impact caused by the interest rate hike.

Expansionary fiscal policy chain of effects

State expenditures are increased → State, for example, has renovated universities → Income for construction companies and their employees increases → Construction companies buy new machines from their income → The machine manufacturers, in turn, buy more raw materials, etc. → In the end, national income increases by a multiple of the original state expenditures. This process is called the multiplier effect.

It can easily be transferred to the restrictive fiscal policy. It works in exactly the opposite way. Reducing government spending or increasing taxes shifts the IS curve to the left and reduces national income and interest rates.

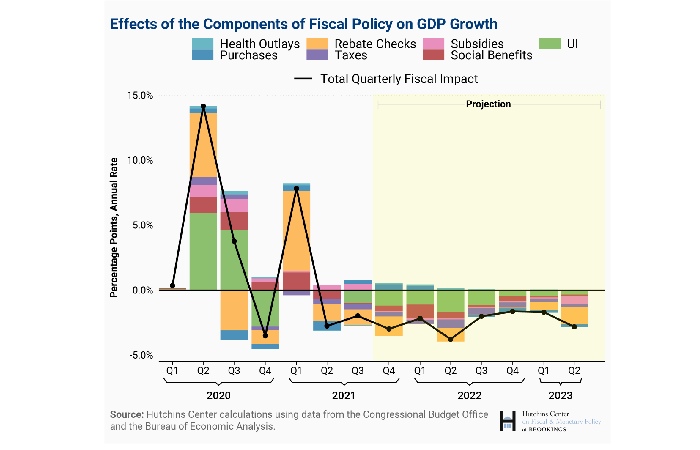

Examples of fiscal policy during covid-19

To reduce the COVID-19 pandemic’s adverse effects on health and the economy, nations worldwide implemented a wide range of budget measures in 2020. there is still uncertainty over how the epidemic will develop.

Despite the high number of COVID-19 cases in several nations, effective vaccinations have been licenced and distributed. The emergence of novel virus strains that spread swiftly and easily and may be linked to a higher risk of death increases the doubt about how quickly the pandemic may be contained.

American Fiscal Policy

The U.S. government passed three primary relief packages and one supplemental package in March and April 2020. After the additional package’s adoption in April—also known as “phase 3.5″—Congress took no significant action on COVID-19 stimulus or relief for several months.

To alleviate the effects of COVID-19, the Member States of the European Union have resorted to increasing public spending, one of the fiscal policy tools. Which of the following is an example of an expansionary fiscal policy?

- We explain what fiscal policy is.

- Find out what their main goals are.

Fiscal policy, supported by monetary policy, has been the main defence against the pandemic’s havoc on the economy. In our country, the pandemic has caused the largest increase in public spending in democracy.

In July 2020, the European Council agreed on an exceptional temporary recovery instrument known as Next Generation EU, endowed with 750,000 million euros for all Member States. This Recovery Fund guarantees a coordinated European response regarding the Member States’ fiscal policy to face the pandemic’s economic and social consequences.

According to the IMF, without fiscal support, the devastation on production and employment would have been three times more intense globally.

Types of fiscal policy

There are two types of fiscal policy: expansive and restrictive. We face a comprehensive policy of reduced taxes or increased public spending to stimulate collection demand for goods and services. However, fiscal policy is said to be restrictive when we raise taxes or reduce public spending to achieve the opposite objectives. Which of the following is an example of an expansionary fiscal policy?

Expansive fiscal policy: by increasing public spending or lowering taxes, the disposable income of consumers increases, as well as that of companies. It gives rise to an increase in consumption and investment that translates into an increase in the total demand for goods and services, which impacts positive growth in production, employment, and prices.

Restrictive fiscal policy: If we increase taxes or reduce public spending, the immediate effect is a fall in consumers’ and companies’ disposable income, translating into a decrease in use and investment. Consequently, aggregate demand decreases, as do production, employment, and prices.