Did you know that learning how to make an income statement is the reason why every year companies decide to invest in the growth of their business or simply decide to seek new opportunities?

If you kept thinking about the future of your company, then we are doing well! Worrying about growing your dreams makes you a responsible and wise entrepreneur (if not ask Bill Gates).

And regardless of the reason you would like to do an income statement, it is more important to know how to do an income statement correctly. In this note we will tell you what the analysis of the income statement is, how to do it step by step, and, finally, we will give you a template of the income statement format to facilitate the entire process.

Prepare your notepad, your coffee, and your desire to grow your business! That we started at 3,2,1 …

Table of Contents

What is the analysis of the income statement of a company?

The analysis of the income statement of a company belongs to one of the 4 basic financial statements or models that are managed and worked by the accounting area of the organizations. Basically, it is a summary of the profits or losses of a company taking into account a period of time (it can be monthly, quarterly, or even annually).To balance a company the best reviews can be given on monday.com competitors.

What information will you find in the account of an income statement?

Within the analysis of the account of a comprehensive income statement, relevant information on the management of a company is presented, through the gains or profits achieved and losses during a certain period of time and, likewise, it is visualized what were the efforts that have been carried out to achieve these achievements or what are the opportunities for improvement for the company.

Before continuing… Are you feeling confused? If you are an entrepreneur who is just getting involved in the accounting part of your venture, don’t worry! We will explain how to make a basic income statement in a very simple way. But first, we need you to understand why it is so important that you make one.

Let’s see, if you answer most of these questions with a yes; then, it will be more than clear that learning how to make an income statement should be a responsibility and an essential duty in your company.

- Are you new to the financial world and don’t know how to keep your business accounting?

- Do you want to know how profitable your business is?

- Are you interested in knowing the profits and losses of your company?

- Do you want to request a bank loan?

We weren’t wrong, right? We know how important it can be for you and your business to have a document of income and expenses (if not later, how do we justify investing in our dreams?). Financial and administrative-accounting does not have to be a complicated and less boring task, so enjoy with us the step by step on how to make an analytical income statement.

What are the objectives of the accounting income statement?

Now that you know the importance of doing one, then, knowing what the objectives of making an accounting income statement are, will give you the necessary route so that you never forget the purpose of managing your business with an Excel format like this.

- Evaluate the profitability of the company.

- Estimate the credit potential,

- Estimate the amount of time and the certainty of a cash flow.

- Evaluate the performance of the company.

- Measure risks.

- Distribute profits.

- Determine the net profit or loss for a given period of time.

- Detail the achievements (income) and the efforts made (costs and expenses).

More reasons to know how to make a profit and loss income statement in Excel?

We have one more! Having an income statement format allows you to know if your company made a profit (when the achievements are greater than the efforts) or losses (when the efforts were more than the achievements).

So what is that analysis for? Having this information through the exercise of an analytical income statement helps you make important decisions about the present and future of your business.

How to make an income statement step by step?

The income statement determines whether the business made or lost money.

First, the operating income, which is the sale of the company’s total production.

Then, the sales costs include any cost that influences the product to be available to the final consumer,

it can be from logistics expenses, raw materials, products that have to be used or some indirect labor.

Later, if we subtract the sale cost from the sale, it gives us the product profit.

Income – Expenses = Profit

Then you have to add all the expenses and we are going to divide it into two basically:

the administrative operational expenses that are all that the company needs to be able to move, we are talking about the payroll, travel expenses, additional expenses such as cleaning, etc..

Selling operating expenses or sales expenses, we refer to everything that makes the product better known, here we are talking about marketing campaigns, television advertising.

If we subtract from our gross profit or loss, depending on where we are, these expenses give us the operating profit or loss.

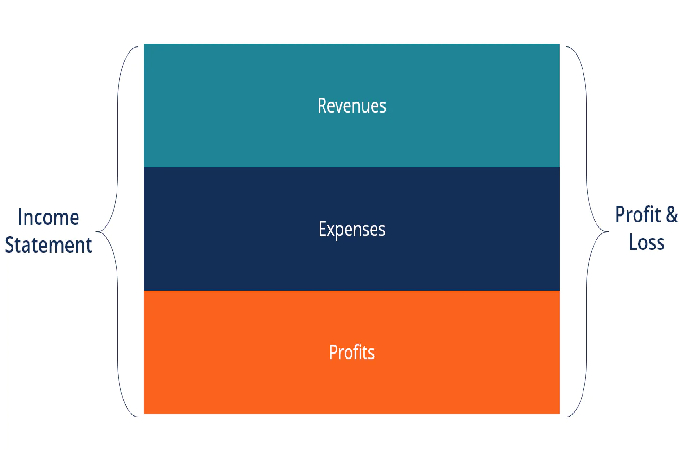

Summarizing the above information, the analysis of the income statement of a company should be divided into 3 main parts: income (all the money that enters the company), expenses (all the money that the company spends), and, finally, it remains a profit.

And how is the final profit or profit determined?

Finally, how to make an income statement for a commercial company or for any business that wants to take financial control of its company, are as follows.

Non-operating income or expenses are everything related to what is not related to the main product of the company.

The subtraction gives us the profit or loss before tax. Now, we put the income tax or any tax that is levied within your local government.

Here is the real profit of the company. Some companies can make reservations, this is if in the future they want to buy or renew or loans.

Making reservations will make you have that money available in the future and deduct it from your earned profit.